This Year's Healthcare Economic Winners

and Losers, and Issue With the Greatest Impact

This week, MCOL released results of the annual

survey of healthcare stakeholders held in

conjunction with the Future Care Web Summit, on

which key topic would have the greatest impact,

and what stakeholders would be economic winners

and losers during this year.

Participants were asked to respond to three

items:

1. Which one of these six topics will

have the greatest impact on stakeholders in

2022?

- Regulatory Health Policy

Changes

- Continued Growth in

Telehealth

- Continued Provider

Economic Losses Resulting from Pandemic

- Increased Utilization/ Negative Outcomes from

Prior Deferred Care

- Provider

Staffing Issues Due to Pandemic/Burnout

- Other Issues

2. Please project who you

think the economic winners and losers for 2022

will be. Who do you think will be economically

better off, the same or worse off by this time

next year: Consumers; Employers; Health Plans;

Hospitals; Physicians; Pharmaceutical

3.

Please indicate your perspective:

Purchaser (Health Plan, Employer, TPA, Agent,

PBM); Provider (Hospital, Physician,

Pharmaceutical, Other Providers); and Vendor or

Other

Stakeholders overwhelmingly

selected “Provider Staffing Issues Due to

Pandemic/Burnout” (49.0%) as the topic having

the greatest impact in 2021, followed by

“Regulatory Health Policy Changes” (17.6%).

Last year – in 2021- 38.2% selected Biden

Regulatory Health Policy Changes, followed by

17.1% for Increased Utilization/ Negative

Outcomes from Prior Deferred Care.

Providers, Purchasers, and Vendors/Others were

relatively equal in naming provider staffing

issues as the highest impact topic, with 52.4%,

50.0% and 46.2% doing so respectively. However,

responses by these categories differed in which

topic followed in being named the highest

impact, with Providers and Purchases listing

Regulatory Health Policy Changes (23.8% and

25.0% respectively) and Vendors/Others naming

Continued Growth in Telehealth (15.4%.)

When ranking these six topics, with 1 being the

highest impact and 6 being the lowest (and only

assigning each number to one topic), Provider

Staffing had the lowest average number ranking

(indicating greatest impact) with 2.41. The

other four specified topics ranged from 3.10 to

3.71, while all “Other Issues” averaged 4.82.

Pharmaceutical was again named the biggest

economic winner for 2022 (56.0% said they would

be better off, compared to 68.4% last year) and

was the only category with greater than 50%

indicating so (Health Plans came in second at

45.1%, and all other categories ranged from

11.8% to 17.6%.).

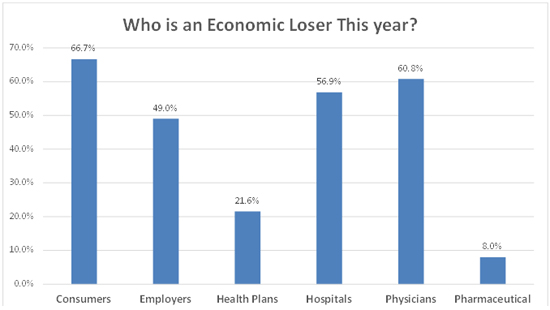

With respect to losers

this year – Consumers again came out on bottom

(66.7% for 2022 and 63.2% in 2021) while

Pharmaceutical again reflected the least

pessimism (8.0% this year and 10.5% in 2021

picked them as losers.)

While zero

percent of Providers Physicians as Better Off in

2022 (compared to 11.8% overall), more

Vendors/Others actually picked them to be worse

off (65.4% said Physicians would be worse off,

compared to 57.1% of Providers.) More

Vendors/Others also felt Hospitals would be

worse off, compared to Providers (69.2% vs.

47.6%).

For

Mor

e Information:

Future Care Web Summit 2022

https://healthexecstore.com/products/webinar-future-care-web-summit-2022